Payment Due Dates

When To Pay the Purchase Price and Ancillary Costs For Real Estate

So, you've finally got your purchase agreement signed and notarized – congrats! That's an incredible milestone on your path to real estate ownership. And it's also time to show the money. You might be wondering: When exactly am I supposed to pay the purchase price? And what about the real estate transfer taxes, notary fees, and the real estate agent's commission? Don't worry if you have no clue whatsoever when any of these are due. We'll explain everything. Here's a tiny spoiler: You won't have to pay everything at once or right away.

- Notary Fees

- Agent's Commission

- Land Registry Fees

- Property Transfer Tax

- Purchase Price

- FAQ

Notary Fees

Notary fees are part of the ancillary purchase costs when buying real estate. The notary will send you a bill to collect their fees when they send you your copy of the purchase agreement. That'll be roughly one to two weeks after the agreement is notarized. You'll have to pay the notary fees immediately. The rate falls somewhere between 0.5% and 1% of the purchase price, depending on how high the purchase price is. But there's no need to worry about unpleasant surprises: The notary's rates are regulated by the German Court and Notary Fees Act (Gerichts- und Notarkostengesetz, GNotKG) and specified in a corresponding schedule of fees. The exact costs will also be included in your purchase agreement. So you'll know what to expect.

Example

For a property worth €200,000, your notary fees will be between €217.50 and €435.

The Real Estate Agent's Commission

You can expect a similar situation with the real estate agent's commission. Once the purchase agreement is signed, the real estate agent's job is done, and a bill will be on its way to you within about a week or two. Payment of the brokerage fee is due fairly quickly as well: You'll have 14 days to settle the bill.

The real estate agent's commission in germany will fall somewhere between 5.95% and 7.14%, depending on which federal state the property is in. Commission rates are not regulated by law, however. If you buy a property for €200,000, the real estate agent's commission can be as high as €14,280.

It's worth noting that if you plan on living in the apartment or house yourself, you'll only have to pay up to 50% of the real estate agent's commission. The same can't be said for all investment properties, however. It's entirely possible that you will have to pay 100% of the real estate agent's commission. How high the commission ultimately ends up being also comes down to what you manage to negotiate, and whatever you settle on will be included in the purchase agreement. So before you sign the agreement, take time to talk to the seller about whether they would be interested in splitting the real estate agent fees with you.

Tip

The real estate agent's commission is considered part of the purchase costs associated with the purchase of real estate as an investment. That means the commission is claimable as a tax deduction as part of the total purchase cost. How? See below under "The icing on the cake for investment properties".

Land Registry Fees

The fees for your various land register entries won't be due right away. That's because these entries, such as the priority notice of conveyance, are not made until four to six weeks after your purchase agreement has been notarized. Your total land registry fees will fall roughly between 0.3% and 0.5% of the purchase price.

Example

Purchase price: €200,000

Land registry fees: €600 – €1,000

Once the land registry's bill is in your hands, you have 14 days to pay it.

Property Transfer Taxes

The bill for your real estate transfer taxes is sent to you by the tax office (Finanzamt) roughly six to eight weeks after your purchase agreement is notarized. After receiving the bill, payment is due within one month (as per Article 15(1) of the German Real Estate Transfer Tax Act). The real estate transfer tax rate differs from state to state, ranging from 3.5% to 6.5% of the purchase price. The real estate transfer tax on a property that costs €200,000 will be between €7,000 and €13,000.

The Purchase Price

The lion's share of the money you owe, i.e., the purchase price, will be due once you receive notice of due payment from the notary. But before they send it to you, there are a few official matters that need to be taken care of first:

All required permits must be obtained (especially in the case of new construction projects)

The priority notice of conveyance must be entered into the land register for the buyer

All land charges must be canceled, or a priority notice of cancellation must be made

The municipality has foregone its right of first refusal (in the event of the sale of land)

You can tell already: there’s quite a lot of paperwork involved in buying a property. It takes a while for everything to be in place before you have to make the final payment—around four to eight weeks.

The Purchase Price Due Notice in a Real Estate Purchase

The due notice (“Fälligkeitsmitteilung”) is a document issued by the notary’s office. In essence, it’s nothing more than a payment request. It states exactly to whom, to which account, and how much you (or your bank) must transfer. As soon as you receive this letter in the mail, you have two weeks to pay the purchase price—provided that everything is as agreed upon in the contract.

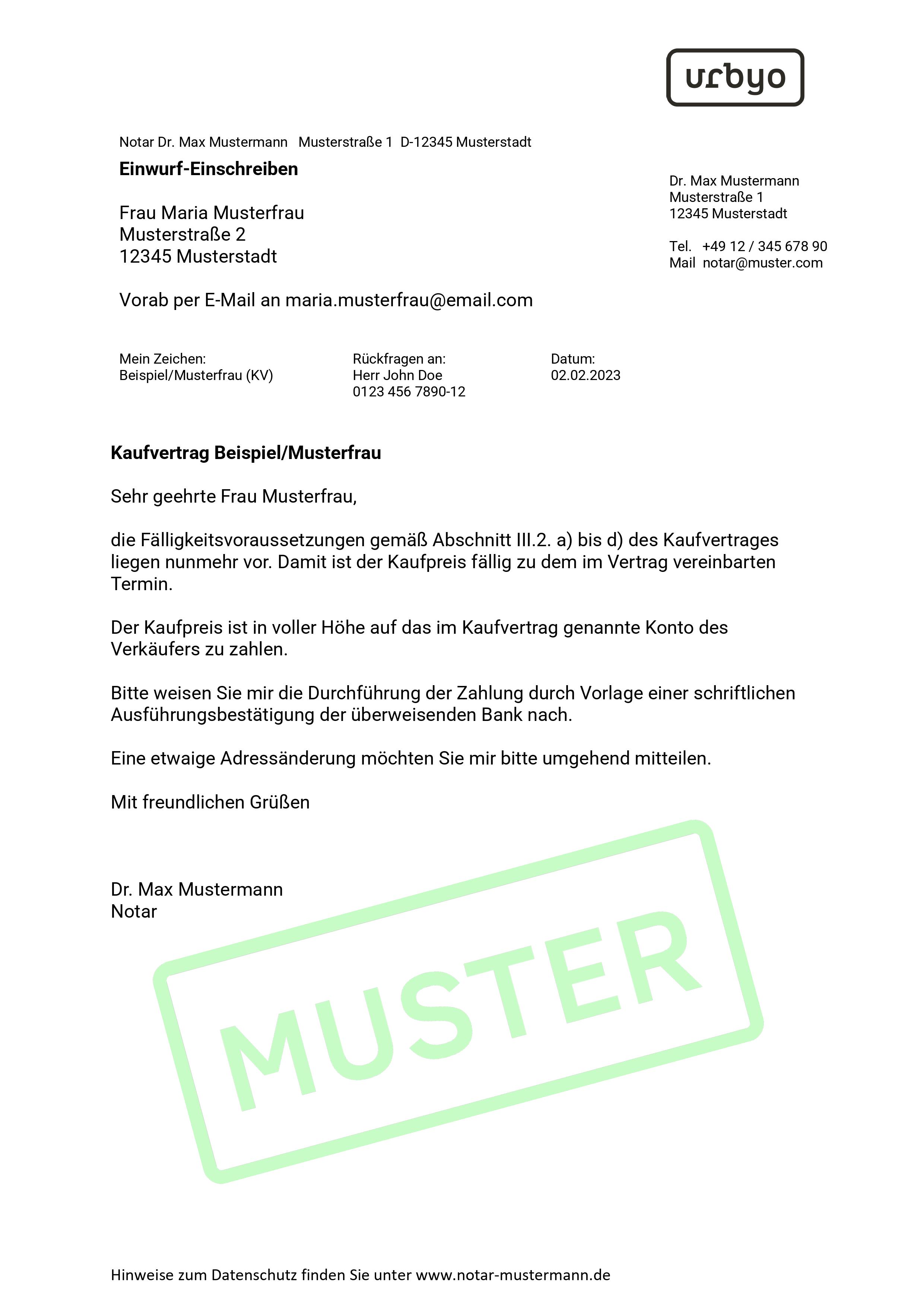

What Does A Purchase Price Due Notice Look Like?

The due notice is a simple letter from the notary’s office. Visually, it doesn’t differ much from other letters of this kind. It states that the conditions for the purchase contract to become due have been met, and that you must now transfer the purchase price to the account specified in the purchase contract.

It often also includes a few additional notes about the invoice or information that the financing bank and the seller have received a copy of the letter. Here’s an example template to give you an idea of what it might look like. 👇

Draft Notice Of Due Payment

The Purchase Price Due Notification Hasn’t Arrived? Possible Reasons Why

If you’ve already been to the notary, secured your financing, and signed the purchase contract, but the due notification still hasn’t arrived, there can be several reasons for that.

Most of the time, it’s because not all of the conditions specified in the purchase contract have been fulfilled yet. The most common issue is that the priority notice of conveyance (“Auflassungsvormerkung”) has not yet been entered in the land register. This process simply takes longer in some places than in others. In most cases, you just need a bit of patience. But if something feels off, you can, of course, follow up with the relevant offices to check on the status.

Important

If you fail to pay the purchase price on time, you'll be required to pay the seller for resulting damages if they choose to claim any. The seller also has the right to back out of the purchase agreement, thus putting an end to the deal.

- Icing on the cake in real estate investing

The Icing On the Cake In Property Investing

The purchase price of your investment property is claimable as a tax deduction (as part of the tax deductions on so-called "purchase/acquisition costs" in Germany). Over the course of an asset life of 50 years (fictitious example), you can deduct 2% of the purchase price from your taxes. That's €4,000 a year. Pretty cool, huh?

If the rental apartment is located inside a building built before 1924 or under monumental protection (Denkmalschutz), you can deduct even more from your taxes: 2.5% of the purchase price each year.

Curious to learn more? Sure thing. Head on over to the Urbyo community to ask questions.