Property Financing In 2025

How to Get the Best Conditions: Info, Tips & Tricks

Most people who buy a property finance at least a large part of the purchase price — whether it’s an investment property or a home they plan to live in themselves.

Many find real estate financing complicated and hard to navigate. And honestly, it often is. That’s why at Urbyo, we’re working to make the real estate market more accessible and the entire buying process simpler for everyone. A key part of that is, of course, financing. It’s all about finding a loan that fits your financial situation, is sustainable in the long term, and aligns with your property goals.

That’s why you’ll find here straightforward and easy-to-understand information about real estate financing — to help you get a clear picture of your options. And if you’d rather talk directly with one of our financing experts first, you can easily book an appointment 👇. Otherwise, dive right into the guide below. 🙌

- Definition

- Financing Options

- What Matters

- Calculator

- Comparing Offers

- Documents

- Securing Financing

- FAQ

Definition: What Is Real Estate Financing and How Does It Work?

Real estate financing refers to a loan you take out from a bank to buy or build a property. There are different types of loans, such as construction financing, where you receive a loan from the bank to cover the purchase or construction costs of the property.

Repayment usually takes place through monthly installments, which consist of two parts: the repayment portion (the amount that reduces your loan balance) and the interest portion (the cost you pay for borrowing the money). Over time, as the loan balance decreases, the interest portion gets smaller and the repayment portion increases.

The amount of your monthly payments depends on several factors — mainly the size of the loan, the fixed interest rate period, and the overall term. Usually, you have the option to adjust your monthly payments if your financial situation changes.

In most cases, you can also make extra payments outside of your regular installments — this is called a special repayment. It allows you to pay off your loan faster and save on interest.

If you want to play around with different interest rate scenarios to get a better feel for how they affect your payments, check out our online calculator. 🙌📈

Types of Real Estate Financing: What Are Your Options?

If you’re planning to buy a property, there are several ways to structure your financing. Here’s a quick overview of some of the most common types of real estate loans.

Construction Financing – The Classic Option

One of the best-known forms of real estate financing is construction financing. In this case, you take out a loan from a bank to finance the purchase or construction of a property. The property itself serves as collateral for the loan. Repayment takes place through monthly installments, which consist of a repayment portion and an interest portion.

Annuity Loan

The annuity loan is a specific type of construction financing. Here, a fixed interest rate is agreed upon for the entire loan term. The monthly payments remain the same throughout, even though their composition changes over time: a larger portion goes toward interest at the beginning, while the repayment share increases as the loan balance decreases.

Bullet Loan (Endfälliges Darlehen)

With a bullet loan, you don’t make any repayments during the loan term. Instead, you pay back the entire loan amount in one go at the end of the term — while paying only the monthly interest in the meantime.

This setup has two key advantages:

First, the interest payments can be deducted as business expenses, which can be particularly interesting for rental properties, as it allows for a consistent deduction amount each year. Second, you can save the repayment amount separately, for example through a repayment savings plan or investment fund. If the returns from that investment exceed the interest you’re paying, you can build up the repayment amount — or at least part of it — faster.

Repayment Loan (Tilgungsdarlehen)

With a repayment loan, the repayment portion remains the same throughout the entire term. This results in a linear decrease of the remaining debt. For example, with a 5% repayment rate, a €100,000 loan would run for 20 years. As you gradually repay the loan, the interest payments decrease accordingly.

Unlike an annuity loan, the total monthly payment isn’t constant, since the interest portion shrinks over time while the repayment portion stays the same.

Forward Loan (Forward-Darlehen)

A forward loan is a type of follow-up financing that allows you to lock in an interest rate several years before your current loan expires. This can be particularly attractive if you expect interest rates to rise.

There are two types of forward loans:

In a true forward loan, the fixed interest period starts only after your existing loan term ends.

In a non-true (or pseudo) forward loan, the fixed interest period begins immediately when the new contract is signed.

Cap Loan (Cap-Darlehen)

A cap loan has a variable interest rate but comes with a maximum limit — the eponymous cap. In return for this cap, you pay a so-called cap premium, which depends on the interest ceiling and the loan term. There is also a minimum limit, called the floor. Among private investors, however, cap loans are not particularly common in the real estate world.

Building Savings Contract (Bausparvertrag)

You’ve probably heard of the classic building savings contract. It starts with a savings phase, during which you decide how much money to deposit. Once you’ve accumulated the minimum required balance, and your creditworthiness has been assessed, the loan phase begins. Essentially, it functions like a standard annuity loan, except that the amount of your savings is credited against the loan amount.

An important point to note about building savings contracts: the loan can only be used for investments with residential purposes.

KfW Loan (KfW-Darlehen)

You’ve probably also heard of KfW loans in the context of real estate financing. These are subsidized loans that make your financing more affordable. For many projects, a KfW loan can be a valuable addition — for example, for energy-efficient renovations or construction projects, provided certain framework conditions are met.

However, you cannot apply for a KfW loan on your own. Our financing experts are happy to handle the application process for you.

Choosing the right financing depends on several factors, including your income, creditworthiness, and the level of risk you’re comfortable with. That’s where our Urbyo experts come in. Together, you’ll analyze your situation, your goals, and the current market conditions — leaving you with just one task: making the final decision.

What to Watch Out for in Real Estate Financing: Your Checklist

When it comes to real estate financing, there are a few key factors you should keep in mind. So here’s a quick checklist of the most important things to think about before making any big decisions:

Property Financing: Your Checklist

Before moving forward, make sure to clarify your budget and decide how much you’re willing to invest in the financing.

Choose the loan type that fits your individual needs and financial situation, such as an annuity loan or construction financing.

Carefully review the loan terms and watch out for hidden costs, like processing fees or commissions.

Calculate the monthly payments thoroughly, taking into account potential interest rate changes or unexpected expenses.

Compare offers from different providers and check reviews or experiences from other clients.

Look for flexibility in repayment so you can respond to unforeseen events if necessary.

Consider whether you want to use additional financing options, such as grants, subsidies, or your own equity.

Finally, plan for adequate protection, like a term life insurance, to cover financial risks.

How Much Equity Do I Need for My Real Estate Financing? Our Online Calculator

In principle, you don’t need any equity to finance a property. Still, your equity plays a crucial role. The higher your equity share, the better the terms you’ll often be able to secure for your financing.

The portion of a property’s value that you cover with a loan is called the loan-to-value ratio. The best financing terms are usually offered at around 60% financing — meaning you contribute 60% of the purchase price as equity and finance the rest. Beyond that, the terms typically change in 5% and then 10% increments.

You can find more details in our podcast episode on the topic. 🎧

As you can see, there’s no one-size-fits-all answer to how much equity you need for your real estate financing. It depends on your personal situation, your goals, and the property itself. That’s why it’s a good idea to create a realistic budget before starting the financing process and to compare the terms offered by different providers to find the best solution for your individual needs.

With our online real estate financing calculator, you can experiment a bit and get a better feel for what works for you. 🙌

Comparing Offers: Where Can You Get Real Estate Financing?

When looking for real estate financing, there are several ways to find offers. The most common options are (online) banks and building societies (Bausparkassen). Since property financing usually involves large sums, even a 0.1% difference in interest rates can make a significant impact. But that’s not the only reason why you should always compare offers before committing.

It’s worth comparing offers because terms can vary significantly from one provider to another. Key factors to consider include the effective annual interest rate, the loan amount, the term, and the monthly payments. Other important aspects might be repayment flexibility or the option for special repayments.

Comparing options can help you save money and tailor your financing to your individual needs. At Urbyo, we don’t leave you to do it alone. Your dedicated advisor will search for the best offers on your behalf — all you have to do is make the final decision and wait for your loan approval.

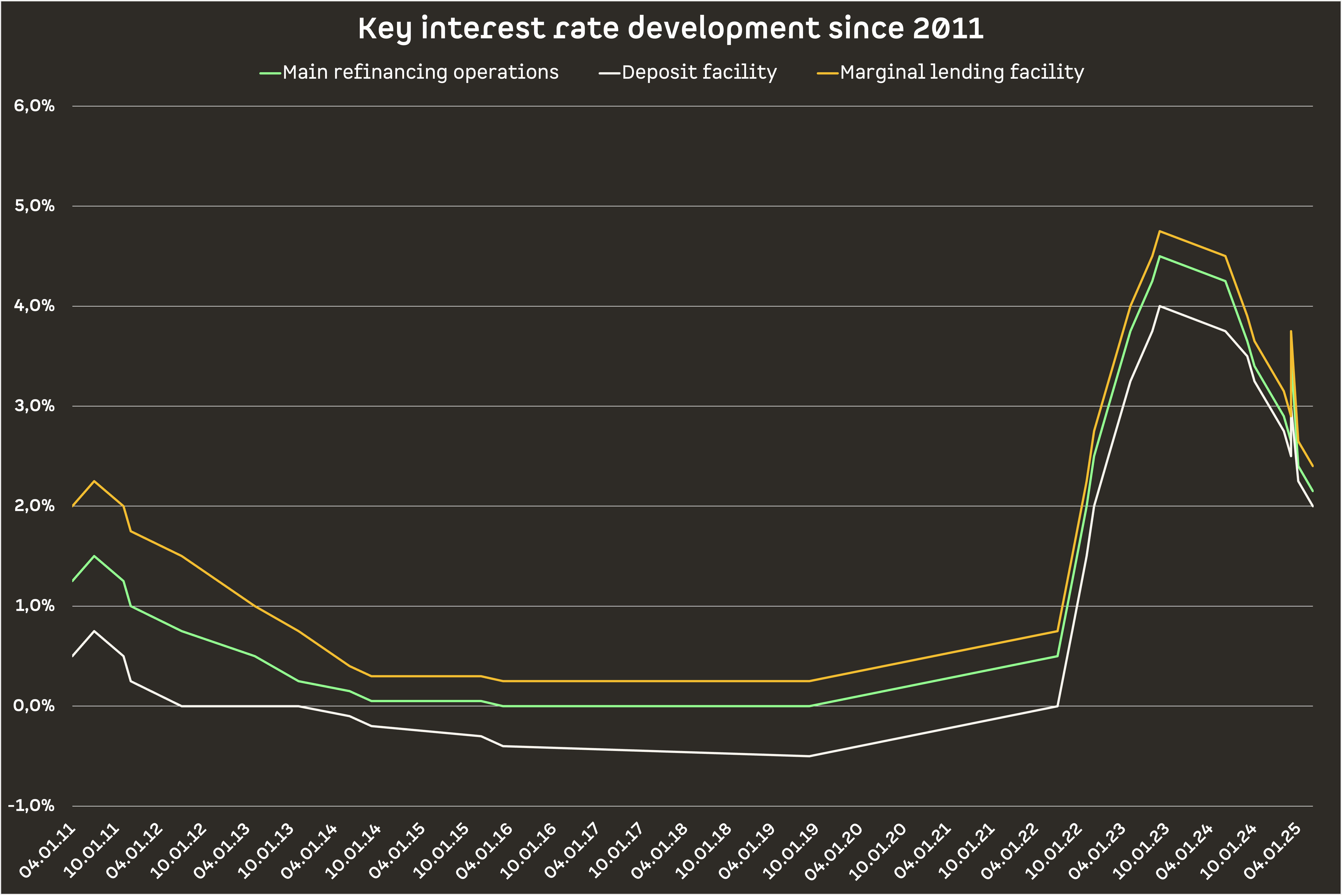

Current Interest Rates and Inflation Trends in the Chart

When looking for affordable financing, the interest rate is, of course, the most important factor. Rates vary from bank to bank and also depend on factors like how much equity you’re putting in.

At the same time, interest rates are heavily influenced by the current key interest rate, which has recently risen due to inflation. After years of a low-interest environment, this increase has caused quite a stir in the market.

The fact that real estate financing is more expensive now than it was a year or two ago isn’t exactly great news on its own. Whether you’re buying a property as an investment or to live in yourself, you want the best possible deal.

But here’s the silver lining: higher interest rates also create an opportunity to negotiate the purchase price. For years, this was almost impossible, but in today’s market, it’s very much within reach.

Is the Best Real Estate Financing Always the Cheapest?

Of course, the best real estate financing isn’t automatically the cheapest. The loan terms are especially important if you’re buying property as an investment, as they directly affect what you can afford and have a major impact on your returns.

At the same time, your financing needs to fit you, your situation, and your plans for the coming years. That’s why it’s important to consider features like special repayments, fixed interest periods, or prepayment options — not just the headline interest rate.

Credit Guidelines & Requirements for Financing Residential Properties

Credit guidelines are the conditions under which banks approve your real estate financing. There are a few key requirements you need to meet.

First and foremost, you need a regular income to cover your monthly payments and good creditworthiness so the bank can grant the loan. To assess this, banks usually check your credit report and overall financial reliability.

The equity you contribute to the financing also matters. The higher your equity share, the better the terms you’re likely to receive. Additionally, banks often require protection against potential risks, such as a term life insurance or a loan protection insurance.

To make sure you don’t lose track before submitting your financing request, you can easily download your checklist here. 👇

Once you have all your documents ready and meet the key requirements, there’s really nothing standing in the way of your real estate financing.

Make Your Real Estate Financing Dream Come True with Urbyo

Sometimes, the dream of financing a property falls apart because people don’t compare different offers or financing options thoroughly enough. With Urbyo, that won’t happen.

Now you have a clear overview of real estate financing and know what to watch out for. It’s time to dive into the details. Your personal advisor will guide you, answer all your questions, and together you’ll find the perfect-fit financing that matches both you and your project. After that, you’ll receive the offers, make your choice, and simply sit back while waiting for your loan approval.